The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website.

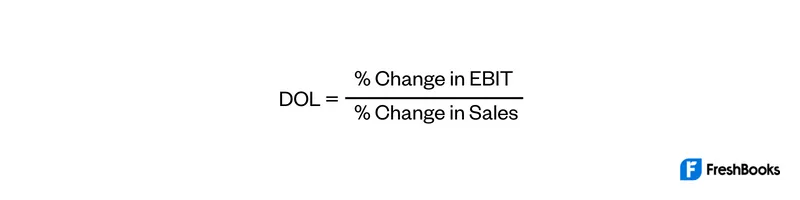

It is a key ratio for a company to determine a suitable level of operating leverage to secure the maximum benefit out of a company’s operating income. Investors can come up with a rough estimate of DOL by dividing the change in a company’s operating profit by the change in its sales revenue. But this comes out to only a $9mm increase in variable costs whereas revenue grew by $93mm ($200mm to $293mm) in the same time frame. Despite the significant drop-off in the number of units sold (10mm to 5mm) and the coinciding decrease in revenue, the company likely had few levers to pull to limit the damage to its margins. However, the downside case is where we can see the negative side of high DOL, as the operating margin fell from 50% to 10% due to the decrease in units sold.

Consider, for instance, fixed and variable costs, which are critical inputs for understanding operating leverage. It would be surprising if companies didn’t have this kind of information on cost structure, but companies are not required to disclose such information in published accounts. Companies with high operating leverage can make more money from each additional sale if they don’t have to increase costs to produce more sales.

Later on, the vast majority of expenses are going to be maintenance-related (i.e., replacements and minor updates) because the core infrastructure has already been set up. A company with a high DOL coupled with a large amount of debt in its capital structure and cyclical sales could result in a disastrous outcome if the economy were to enter a recessionary environment. Common examples of industries recognized for their high and low degree of operating leverage (DOL) are described in the chart below. The DOL would be 2.0x, which implies that if revenue were to increase by 5.0%, operating income is anticipated to increase by 10.0%. As a hypothetical example, say Company X has $500,000 in sales in year one and $600,000 in sales in year two.

A company with high operating leverage has a large proportion of fixed costs—which means that a big increase in sales can lead to outsized changes in profits. A company with low operating leverage has a large proportion of variable costs—which means that it earns a smaller profit on each sale, but does not have to increase sales as much to cover its lower fixed costs. A high DOL indicates that a company has a larger proportion of fixed costs compared to variable costs. This suggests that the company’s earnings before interest and taxes (EBIT) are highly sensitive to changes in sales.

In other words, the numerical value of this ratio shows how susceptible the company’s earnings before interest and taxes are to its sales. The DOL is calculated by dividing the contribution margin by the operating margin. For example, the DOL in Year 2 comes out 2.3x after dividing 22.5% (the change in operating income from Year 1 to Year 2) by 10.0% (the change in revenue from Year 1 to Year 2). Companies with a low DOL have a higher proportion of variable costs that depend on the number of unit sales for the specific period while having fewer fixed costs each month.

As it pertains to small businesses, it refers to the degree of increase in costs relative to the degree of increase in sales. Semi-variable or semi-fixed costs are partly variable and partly fixed. This means that they are fixed up to a certain sales volume, varying to higher levels when production and sales volume increase. Intuitively, the degree of operating leverage (DOL) represents the risk faced by a company as a result of its percentage split between fixed and variable costs. Calculate degree of operating leverage in the following cases and identify which company will experience largest increase in operating income in response to a 15% increase in sales. It also implies that the company will have to drastically grow revenues to maintain profits and cover the fixed costs.

In this best-case scenario of a company with a high DOL, earning outsized profits on each incremental sale becomes plausible, but this type of outcome is never guaranteed. If sales and customer demand turned out lower than anticipated, a high DOL company could end up in financial ruin over the long run. As a result, companies with high DOL and in a cyclical industry are required to hold more cash on hand in anticipation of a potential shortfall in liquidity.

This section will use the financial data from a real company and put it into our degree of operating leverage calculator. Although you need to be careful when looking at operating leverage, it accounts payable ledger definition format and posting can tell you a lot about a company and its future profitability, and the level of risk it offers to investors. While operating leverage doesn’t tell the whole story, it certainly can help.